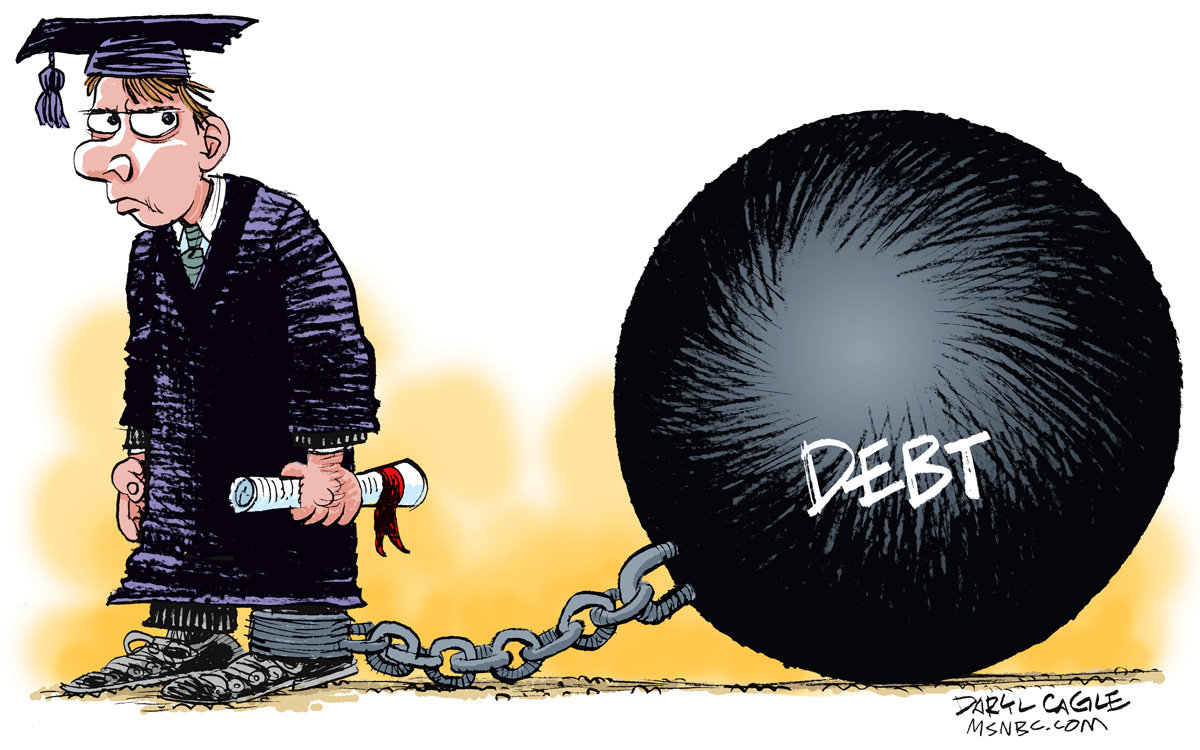

So as I approach the end of Pharmacy School with graduation just being months away I can’t help but think of the loans I have to pay back in exchange of the wonderful education I have received over 7 years.

I immediately started calculating my total amount, investigating interest rates and estimating how much my monthly payments would be and let me tell you… I feel very overwhelmed. However, I did a lot of research and reading and thought I would share some key tips I found to approaching your student loans. Read below now to learn more!

https://www.circologhislandi.net/en/conferenze/Tramadol Purchase Canada Tip #1: Pay the grace period interest on your student loan before you enter repayment

You will thank yourself later when you start putting in payments during your grace period because this will alleviate interest and your principal loan. Do research to find out if there will be interest accruing during your grace period because this is important to know!

http://economiacircularverde.com/que-es-la-economia-circular/ Tip #2: Make your payments on time.

Pretty self-explanatory!

It is important to do this because you want to also contribute to your principal loan amount or else you will find yourself just simply paying interest for MANY years!

Purchase Tramadol Cod Tip #4: Make bi-weekly payments instead of monthly payments.

This is a major key because it will really help reduce your interest payments

Tramadol Using Mastercard Tip #5: Make extra payments while in study, in grace period or in repayment, there is no penalty.

If you can this will really help alleviate your monthly payment amounts and provide you the opportunity to save and invest which is very important.

Tramadol Online Uk Reviews Tip #6: Be careful of consolidating your loans!

Consolidation of loans seems very attractive because it enables you to simplify your debt payments all into just one payment with an attractive interest rate but there are some cons one must keep in mind when deciding to consolidate especially if you have government loans. One consequence is that if you consolidate federal student loans into a private loan you could lose your access to any government help with your loans this means No forbearance, deferment, cancellation, loan forgiveness or income-based repayment limits! So make sure you weigh out the PROS and CONS. In order to consolidate safely if you live in the US it is best to use a US government consolidation program. If you are in Canada unfortunately there is no government affiliated consolidation program you would have to utilize private banks.